Industrials Industry

English Summary:

SCOPE AND OVERVIEW

This methodology represents S&P Global (China) Ratings' supplemental methodology and assumptions for rating industrials entities. Subsectors that would typically be covered by this industrials supplemental methodology may include capital goods, engineering and construction, transportation, railroad, and package express. This industrials supplemental methodology is typically applied in conjunction with S&P Global (China) Ratings Corporate Methodology.

This methodology may also apply to other sectors that we deem appropriate for its use, given the characteristics of the sector, or where we believe an individual issuer or issue is best suited to be analyzed using this supplemental methodology.

METHODOLOGY

Business Risk Analysis

Industry Risk

Our industry risk analysis typically considers industry cyclicality, and competitive risk, and growth. Industry cyclicality typically considers exposure to economic, business and other cyclical influences and how these may affect revenues and profitability. Competitive risk and growth looks at the effectiveness of industry barriers to entry; the level and trend of industry profit margins; the risk of secular change and substitution of products, services, and technologies; and the risk in growth trends.

Capital Goods

This sector covers entities that typically derive a majority of their revenues from manufacturing and/or servicing industrial equipment, such as heavy and light industrial equipment, machinery, industrial components, and systems, including providers of related services, such as construction equipment rental entities or industrial distributors. It also covers those that derive a majority of their revenues from the design, manufacture, or repair of civil aircraft, or supply related components or systems, and design, manufacture, or service weapons systems or supply-related components; or provide defense-related services to government agencies or the military.

Engineering and Construction

This sector covers entities that typically derive a majority of their revenues from engineering and design, construction, and maintenance work.

Transportation

This sectors typically cover airlines, shipping entities, trucking entities, and certain miscellaneous other transportation entities, such as bus entities.

Railroad and Package Express

This sector typically covers freight railroads (those that derive a majority of their revenues from freight transportation), package express entities, and logistics entities that provide services that support the movement of goods through the supply chain, such as warehousing, transportation brokerage, inventory management, and materials handling.

Competitive Position (Including Profitability)

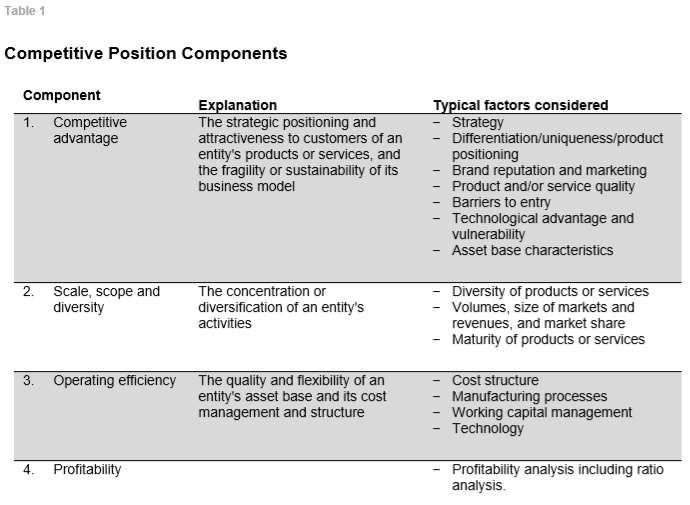

In analyzing the competitive position for industrials entities, we typically consider an individual entity's:

a) Competitive advantage.

b) Scale, scope, and diversity.

c) Operating efficiency.

d) Profitability.

The factors that we may typically analyze when considering competitive position are described below:

a) Competitive Advantage

- In analyzing the competitive advantage of a capital goods entity, we typically consider its business strategy and market position; its product or service profile, including differentiation attributes and bundling characteristics; the effectiveness of its distribution strategy; and if applicable, its track record of execution on project work and the characteristics of its business backlog. In assessing an aerospace and defense entity, we may also consider its technological capabilities.

- In analyzing the competitive advantage of an engineering and construction entity we typically consider its market share in its key markets or regions as an indicator of brand effectiveness or ability to execute, its reputation and brand recognition, its perceived financial stability, and its technology offering.

- In analyzing the competitive advantage of a transportation entity, we typically consider its breadth of the route network; strength of position within markets served; its fleet size and overall attractiveness of fleet, as measured by age and technical characteristics, and service standards and reputation, and attractiveness of markets served.

- In analyzing the competitive advantage of a railroad and package express entity, we typically consider overall route network; strength of position within markets served; service standards (speed, timeliness of delivery, low rate of damage or loss, ability to track shipments easily) and reputation; size of revenue base and unit sales, an advantage given the economies of scale for these entities; and effectiveness of the marketing strategy and sales force, particularly for package express entities but increasingly also for logistics entities and railroads.

b) Scale, scope, and diversity

- In analyzing the scale, scope, and diversity of a capital goods entity, we typically consider the relative size of its revenue base and that of its target markets; the depth and breadth of its product offering; the degree of its end-markets' diversity; the geographic balance of its sales, its profits and manufacturing footprint; and the degree of its customer and supplier concentration.

- In analyzing the scale, scope, and diversity of an engineering and construction entity, we typically consider the size of revenues generated by its core businesses; construction volume; degree of geographic concentration; end-market diversity; degree of customer and contract concentration; and types and scope of services provided.

- In analyzing the scale, scope, and diversity of a transportation entity, we typically consider geographic coverage of route network; sector/end-market exposure; degree of customer concentration. For airlines, we may also consider mix of business and leisure travelers and other non-passenger businesses. For shipping entities we may also consider scale of vessel fleet and multiple classes of vessels which can improve end market and customer diversity. For trucking entities, we may also consider volume, as indicated by tonnage (per day) and number of shipments (per day).

- In analyzing the scale, scope, and diversity of a railroad entity, we typically evaluate its scale, which we measure by freight revenues, volumes, track miles, diversity of customers and end markets served, and types of services provided; and coverage by the track network. For package express entities, our assessment typically includes the route network and position of hubs (to create an integrated network that can handle various products, has access to major markets, and provides national and global coverage); diversity of regions served, which we measure by revenues and operating profits; and diversity of customers and industries served. For logistics entities, our assessment typically includes scale, which we measure by revenues, diversity and size of customers and end markets, and number and specialization of services provided; and geographic footprint--location, plus the diversity and characteristics of markets.

c) Operating efficiency

- In analyzing the operating efficiency of a capital goods entity, we typically consider its relative cost position versus industry peers; the flexibility of its cost structure in absorbing demand declines or input cost pressures; and its cost management and working capital characteristics.

- In analyzing the operating efficiency of an engineering and construction entity, we typically consider the entity's rate of contract wins, changes in contract backlog value, and order cancellation rates by market and versus its peers; the size and frequency of its contract losses; and its cost structure flexibility.

- In analyzing the operating efficiency of a transportation entity, we typically consider its cost structure, measures of asset utilization and efficiency (revenue or cost per unit of capacity), and operating profit margins. Because cost structure tends to be a more consistent differentiating factor than revenue generation, which varies with market conditions, we place greater emphasis on operating costs.

- In analyzing the operating efficiency of a railroad and package express entity, we typically consider its cost structure, measures of asset utilization and efficiency (revenue or cost per unit of per carload or delivery), and operating profit margins for example EBIT margin, and measures related to service quality, such as on-time delivery.

d) Profitability

In analyzing the entity’s profitability, we typically consider the level of profitability, and the volatility of profitability over a medium to longer term timeframe. If the entity has limited historical data, we look at its peers operating in the same sector and use it as a proxy.

Financial Risk Analysis

In analyzing the cash flow adequacy of an Industrials entity, our analysis generally uses similar methodology as with other corporate issuers (see "S&P Global (China) Ratings Corporate Methodology").

Core ratios

In analyzing the cash flow/leverage of Industrials entities, we typically use these core ratios: FFOto-debt and debt-to-EBITDA.

Supplemental ratios

In addition to our analysis of an entity's core ratios, we may consider supplemental ratios to develop a fuller understanding of its credit risk profile and refine our cash flow analysis.

We may consider free operating cash flow (FOCF) to debt as a supplemental ratio for issuers with significant capital expenditure. Alternatively, we may use cash flow from operations to debt for highly working-capital-intensive entities. We may also use discretionary cash flow (DCF) to debt as a supplemental ratio for issuers with high dividend payouts.

If the core ratios are considered weak, we may alternatively use debt service coverage ratios (FFO plus interest/cash interest, or EBITDA/interest as supplemental ratios.

OTHER CONSIDERATIONS

This methodology is not intended to be an exhaustive list of all factors we may consider in our analysis. Where appropriate, we may apply additional and/or different, quantitative and/or qualitative, considerations in our analysis to reflect the circumstances of the analysis for a particular issuer, issue or security type. A rating committee may adjust the application of the methodology to reflect individual circumstances in our analysis.