Consumer Discretionary Industry

English Summary:

SCOPE AND OVERVIEW

This methodology represents S&P Global (China) Ratings' supplemental methodology and assumptions for rating consumer discretionary entities. Subsectors that would typically be covered by this consumer discretionary supplemental methodology may include general retailing, consumer durables, auto and commercial vehicle manufacturing, leisure and sports, and media and entertainment. This consumer discretionary supplemental methodology is typically applied in conjunction with S&P Global (China) Ratings Corporate Methodology.

This methodology may also apply to other sectors that we deem appropriate for its use, given the characteristics of the sector, or where we believe an individual issuer or issue is best suited to be analyzed using this supplemental methodology.

METHODOLOGY

Business Risk Analysis

Industry Risk

Our industry risk analysis typically considers industry cyclicality, and competitive risk and growth. Industry cyclicality typically considers exposure to economic, business and other cyclical influences and how these may affect revenues and profitability. Competitive risk and growth looks at the effectiveness of industry barriers to entry; the level and trend of industry profit margins; the risk of secular change and substitution of products, services, and technologies; and the risk in growth trends.

General Retailing

This sector covers entities that typically sell goods or services directly to the individual consumer through stores, catalogues, or online operations--or a combination of these channels. This can include sectors such as restaurants, and retailers that sell textiles, footwear, apparel, and luxury goods. We also include entities providing services directly to consumers, which can include for example, childcare, education, automated retail, and consumer tax and legal.

Consumer Durables

This sector covers entities that typically derive revenue from the manufacture and marketing of diversified and miscellaneous consumer products, including home appliances, furniture, home improvement products and fixtures, small appliances, sporting equipment, and other durable goods.

Auto And Commercial Vehicle Manufacturing

This sector covers entities that typically derive a majority of their revenues from manufacturing and selling motor vehicles, primarily passenger cars and trucks and, to a lesser extent, vans and buses. It also includes auto and truck component suppliers.

Leisure And Sports

This sector covers entities that typically derive a majority of their revenues from entertainment, lodging, and hospitality entities, timeshare operators, cruise lines, sports teams and sports related entities, fitness club operators, theme parks and other visitor attractions, and toy entities and other leisure goods manufacturers.

Media And Entertainment

This sector typically cover entities in the media and entertainment sector, for example ad agencies and marketing services entities, TV and radio stations, data/professional publishers, E-commerce services, publishing, theater, printing, trade shows, and film and TV programing production.

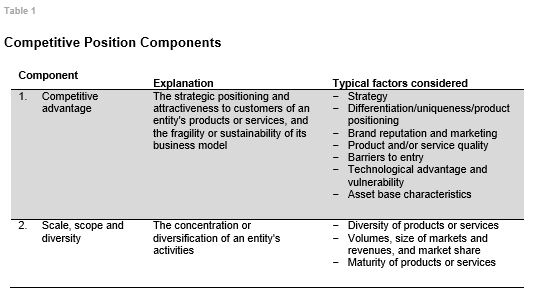

Competitive Position (Including Profitability)

In analyzing the competitive position for Consumer Discretionary entities, we typically consider an individual entity's:

a) Competitive advantage.

b) Scale, scope, and diversity.

c) Operating efficiency.

d) Profitability.

The factors that we may typically analyze when considering Competitive Position are described below:

a) Competitive Advantage

- In analyzing the competitive advantage of a general retailer, we typically consider its merchandising strategy, differentiation of concept/product/shopping experience versus competitors, brand reputation and marketing, product/service-level quality.

- In analyzing the competitive advantage of a consumer durables entity we generally consider its business strategy and market positions; extensiveness of presence in consumer markets and in channels of distribution; product range and differentiation versus competition; brand equity and underlying price power; capital spending plans on production, innovation, sales and marketing; strategies regarding balancing volume growth and margins.

- In analyzing the competitive advantage of an auto and commercial vehicle manufacturing, we typically consider its market share relative to industry peers and for its main product segments, market share compared with the industry average.

- In analyzing the competitive advantage for a leisure and sports entity, we typically consider its degree of brand recognition or franchise strength; relative attractiveness and competitiveness of the market; and asset and/or service quality.

- In analyzing the competitive advantage of a media and entertainment entity, we typically consider brand strength; market position; revenue stability, especially in light of industrywide migration to digital technology; asset quality; and other factors that support pricing leadership.

b) Scale, scope, and diversity

- In analyzing the scale, scope, and diversity of a general retailing entity, we typically consider diversity of product or service range, geographic footprint of store base and prospects of core markets, volumes, size, market share, or niche position in chosen segment, relative attractiveness of the markets (i.e., size, demographics, expected growth, and intensity of competition).

- In analyzing the scale, scope, and diversity of a consumer durables entity, we typically consider the size of its revenues and earnings base in the context of the size and growth potential of its geographical markets and product segments; the depth and breadth of its product offering; the geographical diversity of its sales and earnings; the level and localization of the production capacities and ability of the distribution network to meet demand; and the degree of supplier and customer concentration.

- In analyzing the scale, scope, and diversity of an auto and commercial vehicle manufacturing, we typically consider its revenues and profits across regions and the degree of end-market diversity, its production footprint and degree of geographic concentration, and its supplier concentration.

- In analyzing the scale, scope, and diversity of a leisure and sports entity, we typically consider the degree of diversity by geographic markets; degree of brand, asset, or segment concentration; and scale and related ability to fund large capital expenditures where applicable.

- In analyzing the scale, scope, and diversity of a media and entertainment entity, we typically consider the degree of profitable diversification across a range of products and services, content, audience, titles, or market segment; geographic diversity; and critical mass of operation.

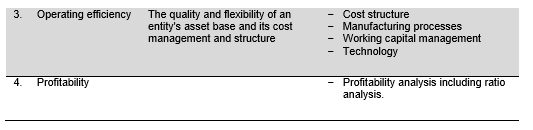

c) Operating efficiency

- In analyzing the operating efficiency of a general retailing entity, we typically consider its same-store sales or like-for-like sales; gross margin; Selling, General and Administrative (SG&A) to sales; sales per square foot; EBITDA margin; inventory turnover; accounts payable days; and cash conversion cycles.

- In analyzing the operating efficiency of a consumer durables entity, we typically consider its flexibility of its cost structure in absorbing demand declines or input cost pressures, cost management, working capital management characteristics, and relative cost position versus industry peers.

- In analyzing the operating efficiency of an auto and commercial vehicle manufacturing, we typically consider its relative cost position vs. industry peers; the location of its industrial footprint, capacity utilization levels, and level of commonality across products; its cost structure flexibility, including fixed/variable cost percentages, ability to reduce costs and manage inventories in a down cycle, and ability to pass on increases in input costs; its track record of cost reductions and capacity adjustment; its working capital management and trend line in working capital metrics; and its track record of integrating any acquired businesses.

- In analyzing the operating efficiency of a leisure and sports entity, we typically consider asset utilization and efficiency metrics (such as revenue per unit where applicable); relative success at managing fixed and variable costs in a downturn compared with peers; and track record at managing large capital investment programs where applicable.

- In analyzing the operating efficiency of a media and entertainment entity, we typically consider cost structure, the extent to which an entity can pare costs in response to client or competitive pressure; and the resulting EBITDA.

d) Profitability

In analyzing the entity’s profitability, we generally consider the level of profitability, and the volatility of profitability over a medium to longer term timeframe. If the entity has limited historical data, we may look at its peers operating in the same sector and use it as a proxy.

Financial Risk Analysis

In analyzing the cash flow adequacy of a consumer discretionary issuer, our analysis generally uses similar methodology to other corporate issuers (see "S&P Global (China) Ratings Corporate Methodology").

Core ratios

In analyzing the cash flow/leverage of consumer discretionary entities, we typically use these core ratios: FFO-to-debt and debt-to-EBITDA.

Supplemental ratios

In addition to our analysis of an entity's core ratios, we may consider supplemental ratios to develop a fuller understanding of its credit risk profile and refine our cash flow analysis.

We may consider free operating cash flow (FOCF) to debt as a supplemental ratio for entities with significant capital expenditure. Alternatively, we may use cash flow from operations (CFO) to debt for highly working-capital-intensive entities. We may also use discretionary cash flow (DCF) to debt as a supplemental ratio for entities with high dividend payouts.

OTHER CONSIDERATIONS

This methodology is not intended to be an exhaustive list of all factors we may consider in our analysis. Where appropriate, we may apply additional and/or different, quantitative and/or qualitative, considerations in our analysis to reflect the circumstances of the analysis for a particular issuer, issue or security type. A rating committee may adjust the application of the methodology to reflect individual circumstances in our analysis.